Glacier's acquisition of Wheatland Bank (Spokane, WA)

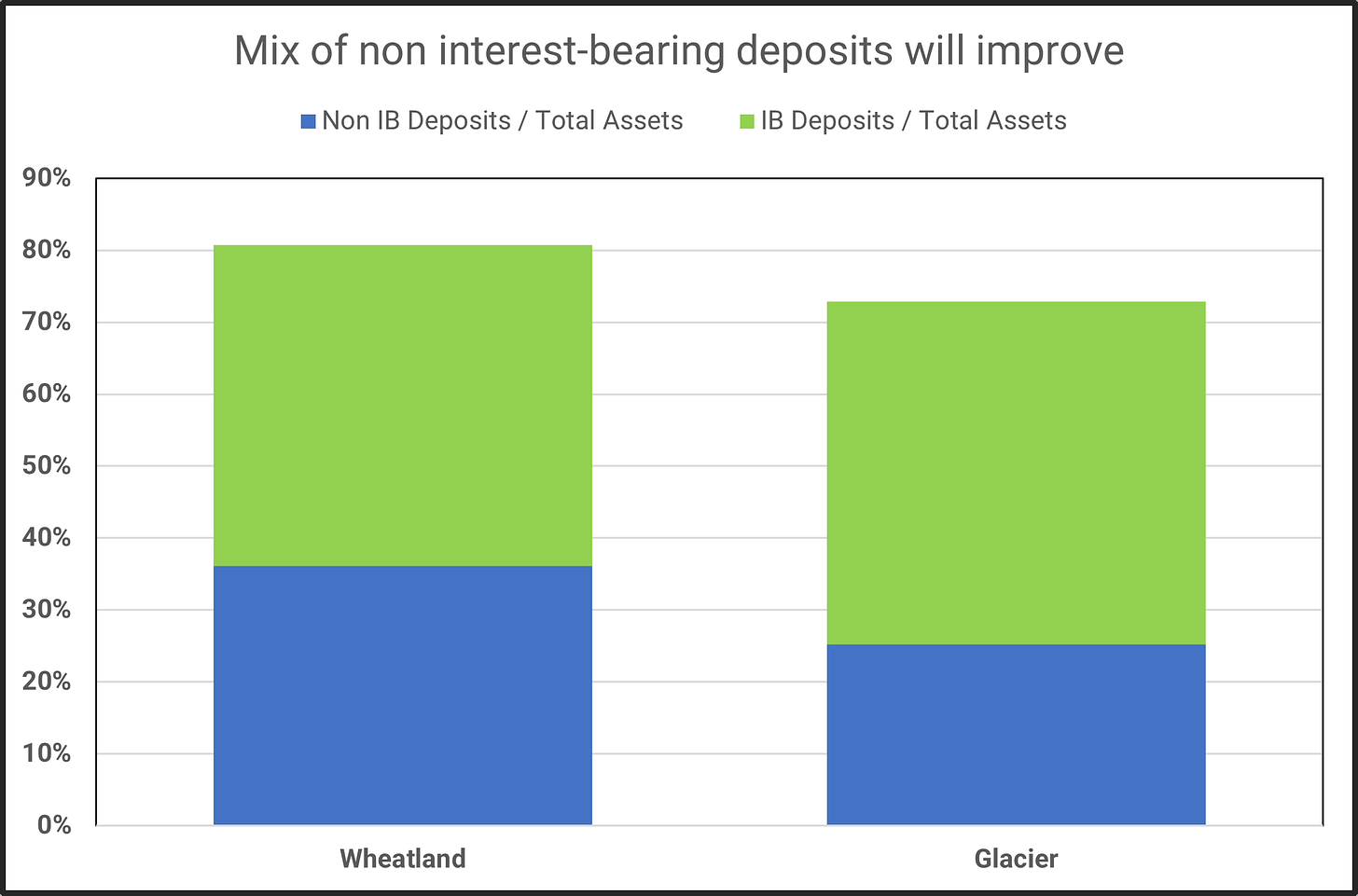

Diversifies customer base, increases mix of non-interest deposit funding, boosts balance sheet liquidity.

Glacier Bank announced the acquisition of Spokane’s Wheatland Bank for $80.6mm in an all-stock deal. The acquisition price - based on today’s closing price of GBCI 0.00%↑ - represents a 50% premium to book value on a non-adjusted basis, and a 10% premium on an adjusted basis that doesn’t factor in the $20mm of loses on Wheatland’s AFS portfolio.

Ignoring any debate about valuation, the acquisition appears to be a smart move on Glacier’s part for the following reasons:

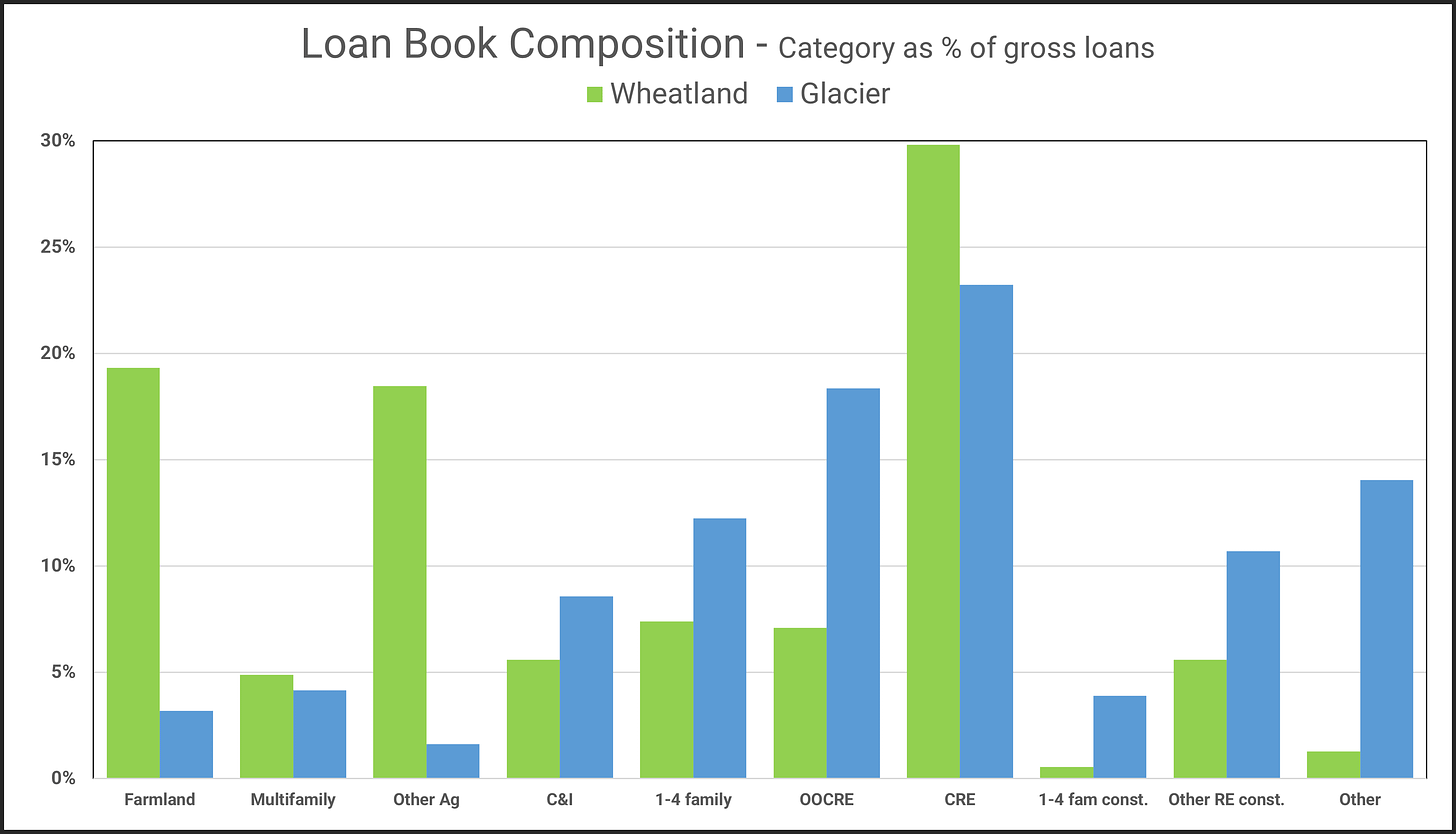

Diversification of loan book. Wheatland has a high concentration of ag borrowers and a low concentration of RE construction loans.

As a percentage of total assets, non-interest-bearing deposits is36% at Wheatland, compared to 25% at Glacier. FWIW, this ratio was 43% for Wheatland in Q1.

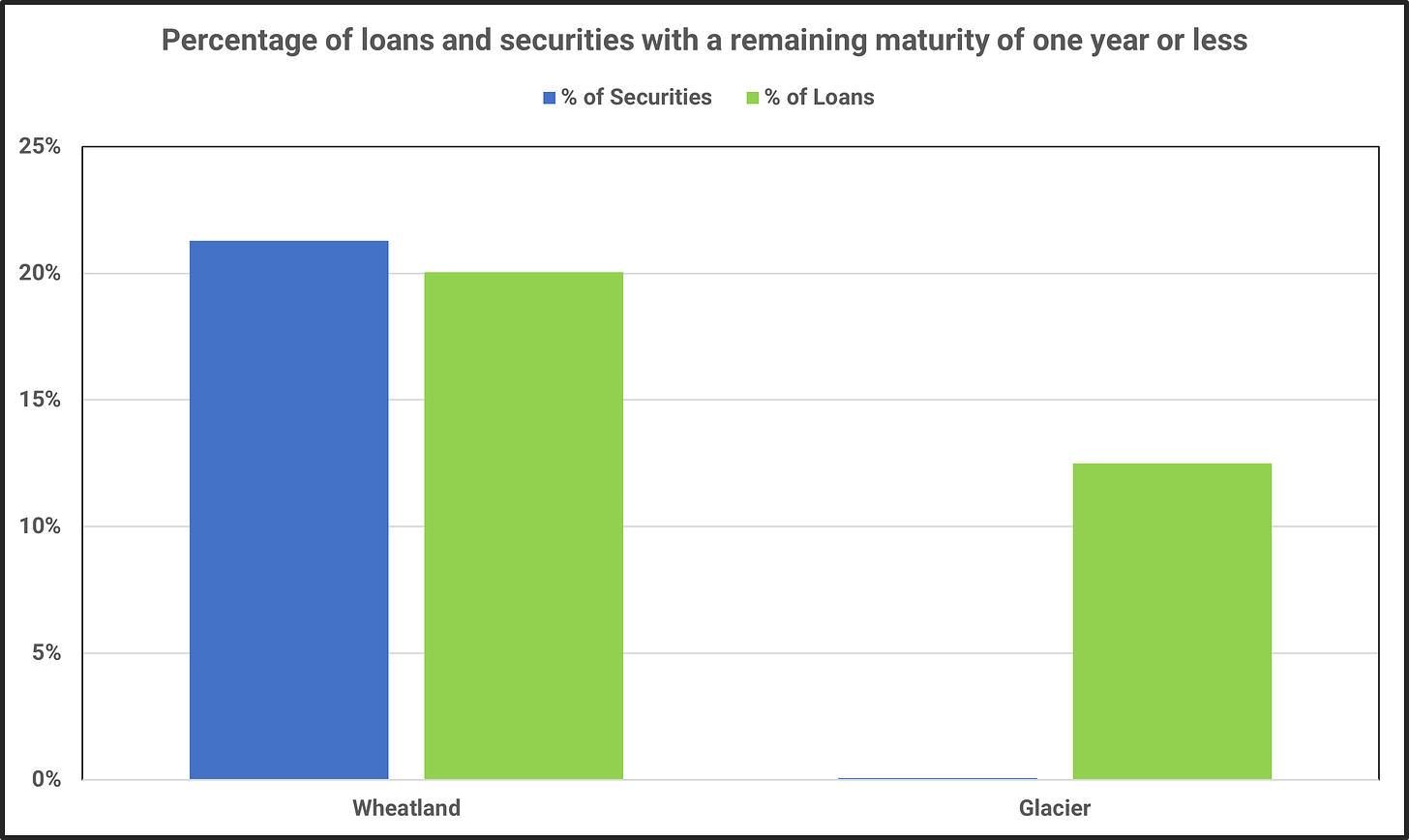

Glacier has a limited amount of reserves and short-term assets that can be quickly liquidated for cash at par values. Only 0.1% of Glacier’s securities portfolio has a remaining maturity of one year of less, compared to 20.1% for Heartland.

Glacier currently has $1.8MM of unadvanced real estate construction loan commitments, which exceeds cash/reserves of $1.05MM.