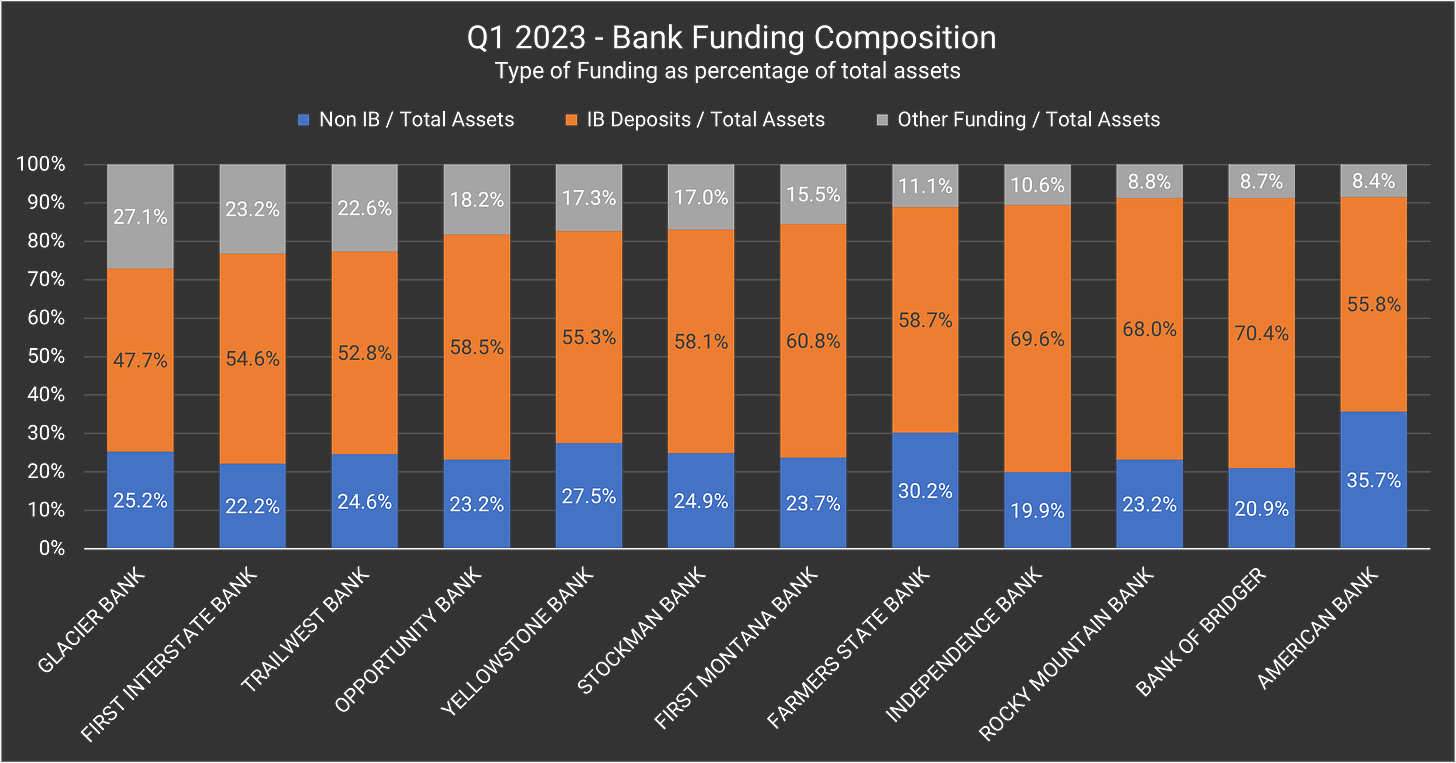

Approximately 60% of bank assets are funded by interest-bearing customer deposits.

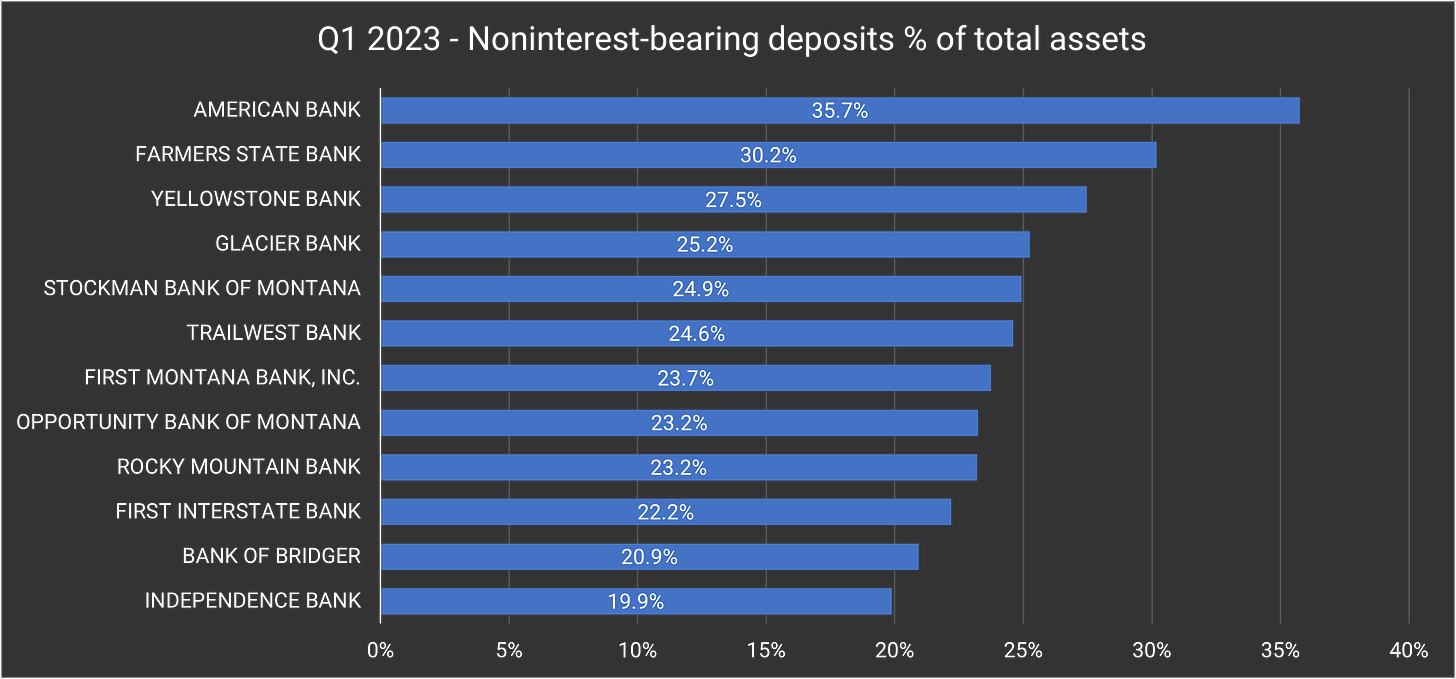

The bank with the highest percentage of noninterest-bearing deposits is American Bank.

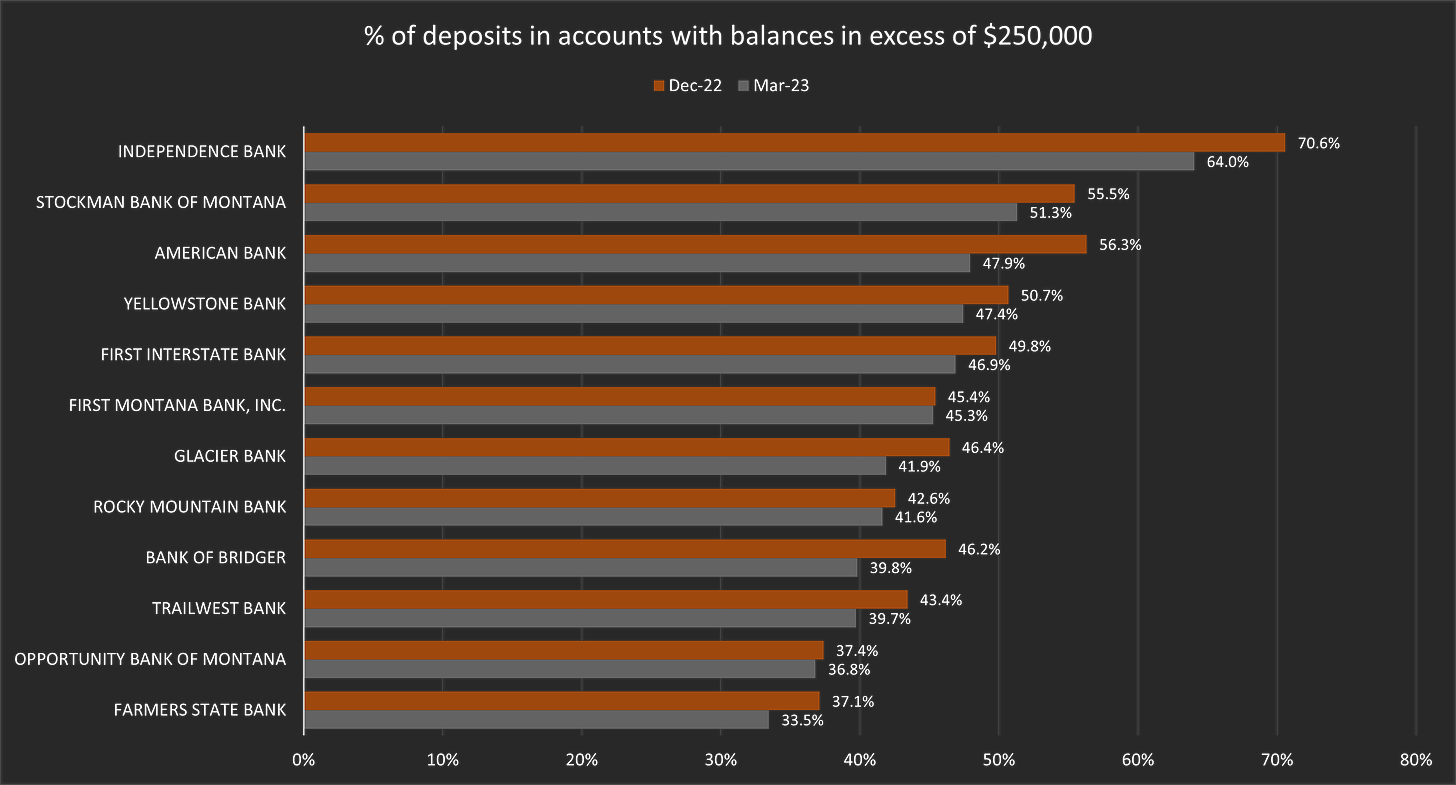

Independence Bank has the most exposure to large non-insured deposit accounts.

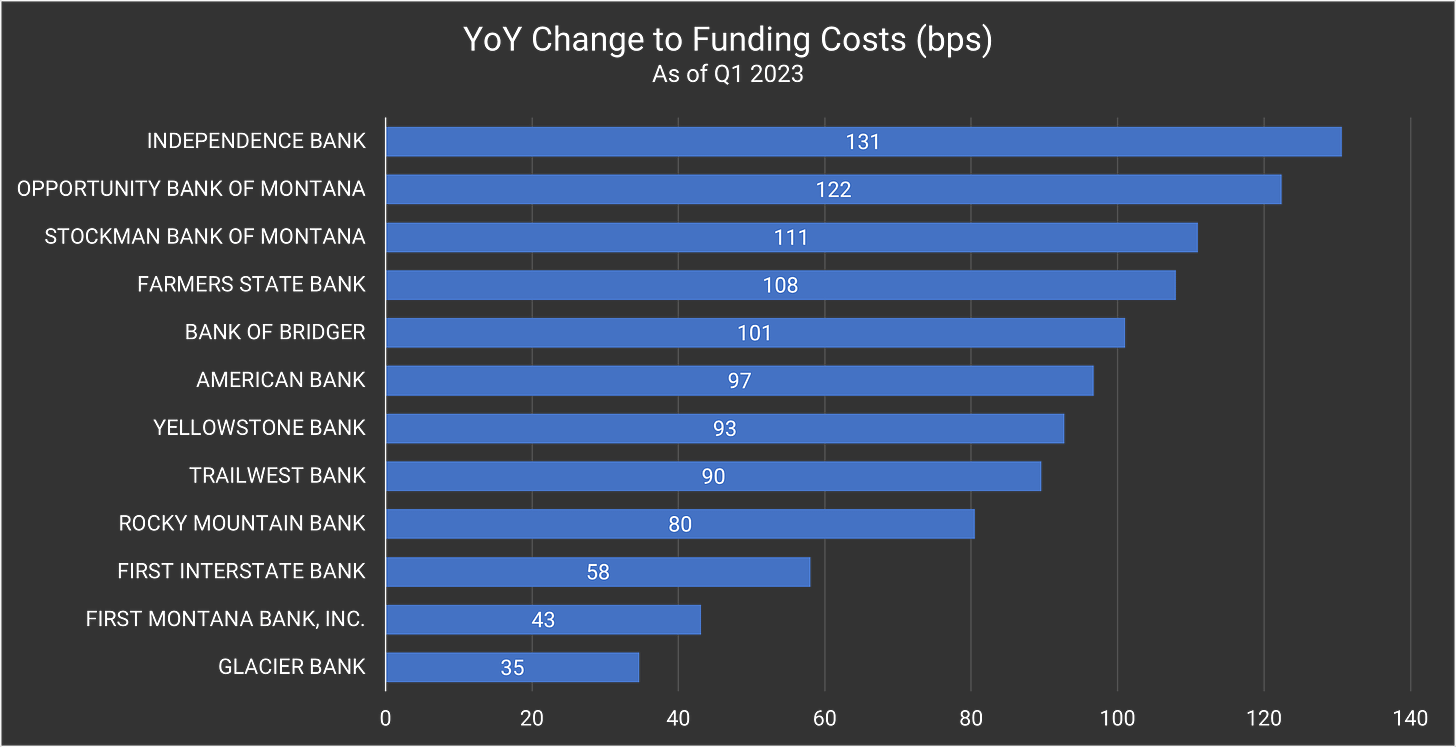

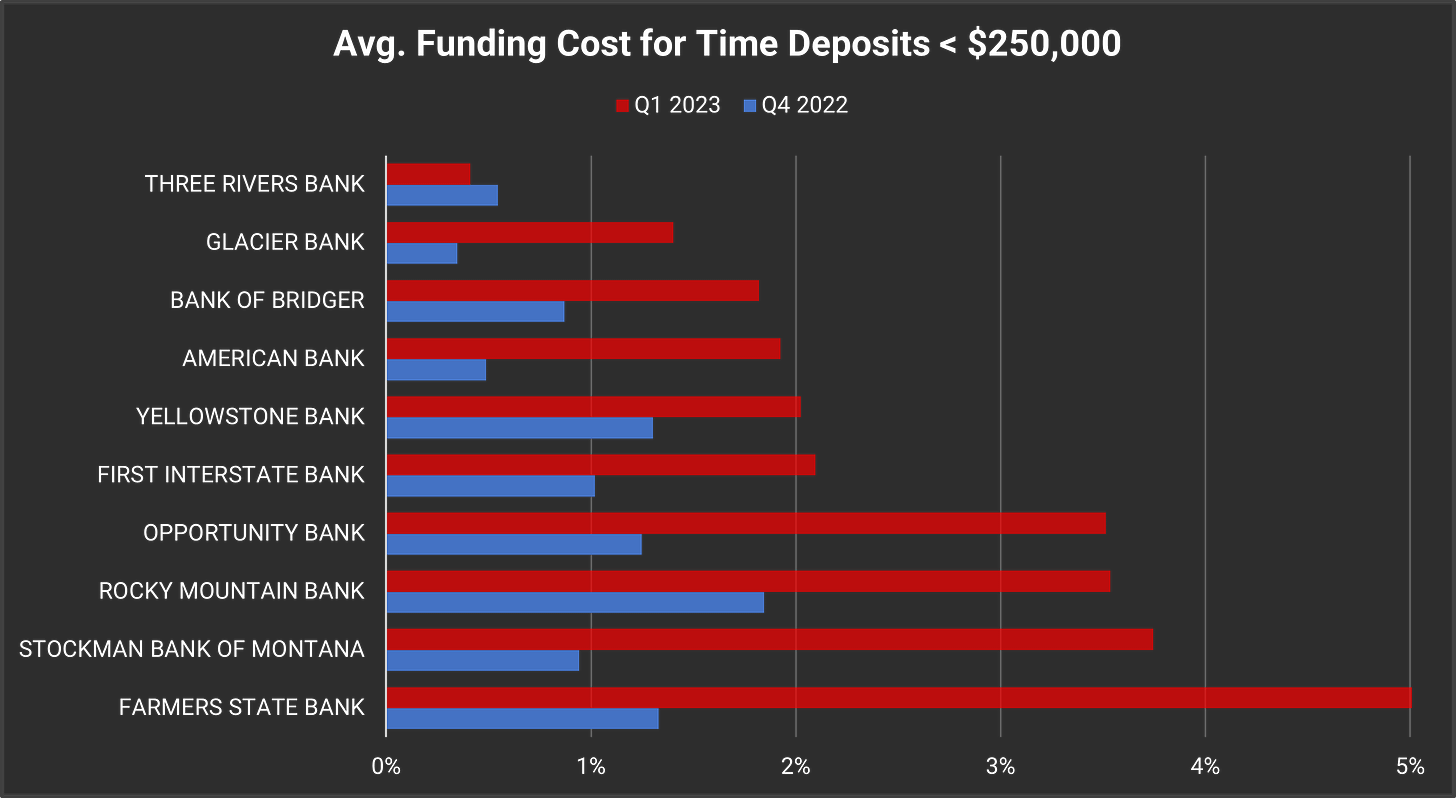

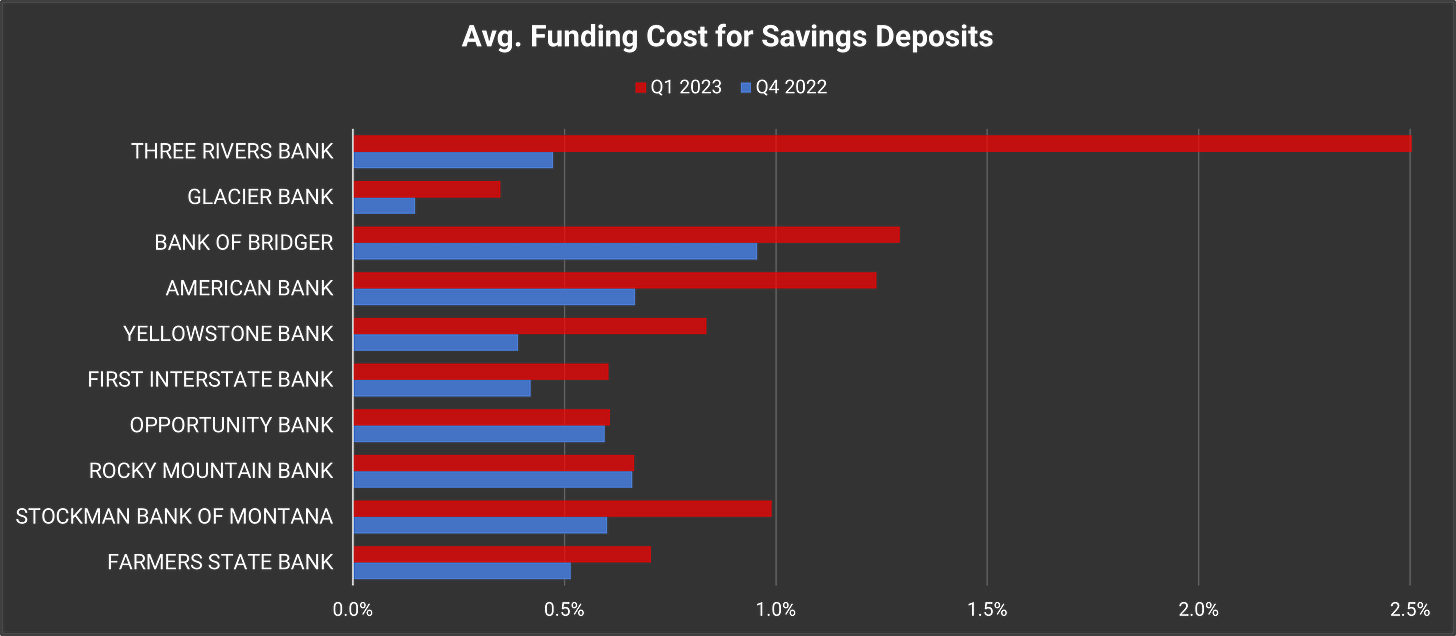

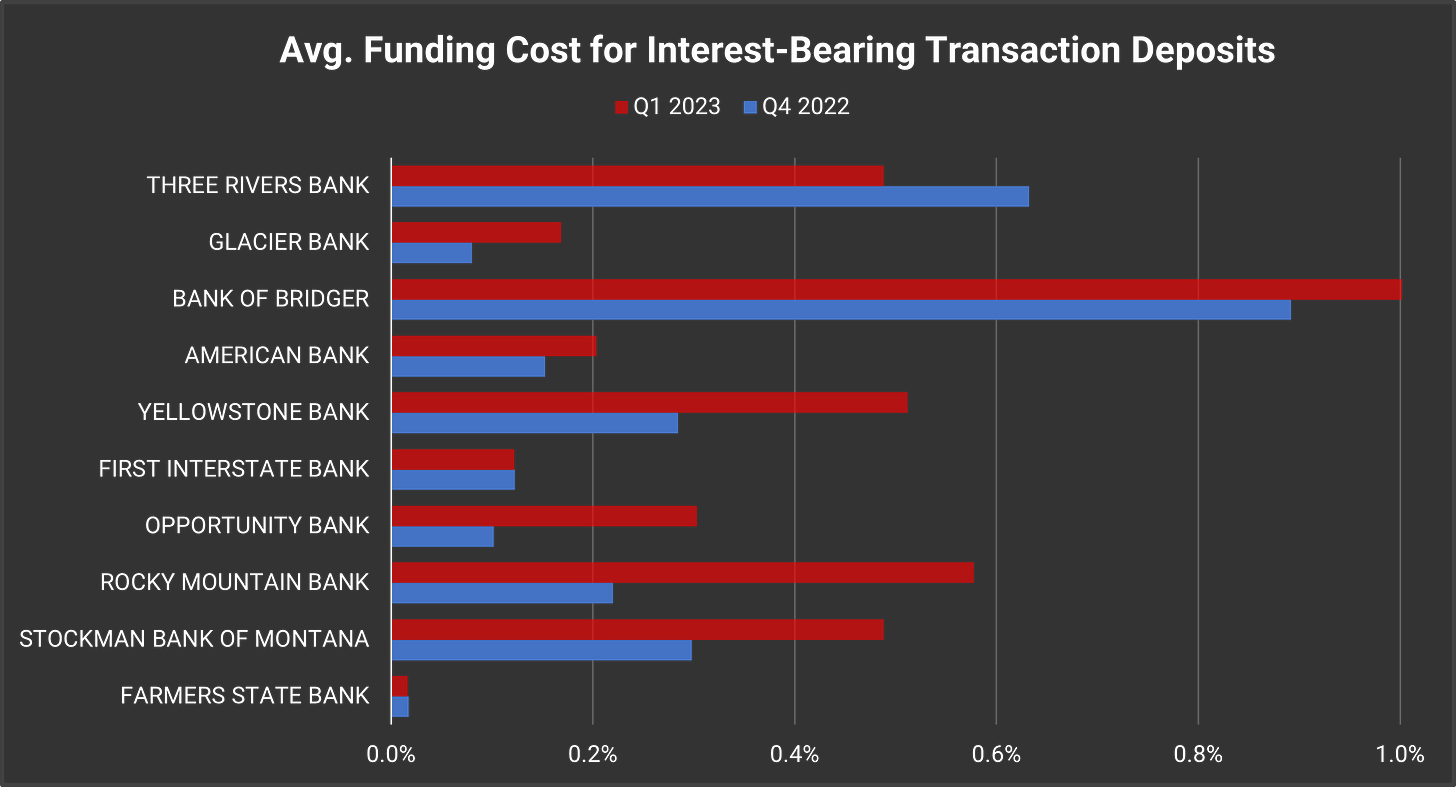

Independence Bank experienced the largest increase to funding costs year-over-year.

Farmers State Bank and Opportunity Bank, who saw funding costs increase by 108 bps and 122 bps, respectively, despite the two having the smallest degree of exposure to non-insured deposits.